Housing in the Wheeling area can be affordable for everyone.

Wheeling is facing many problems with housing, including:

- Homelessness

- Increasing rents

- Abandoned buildings

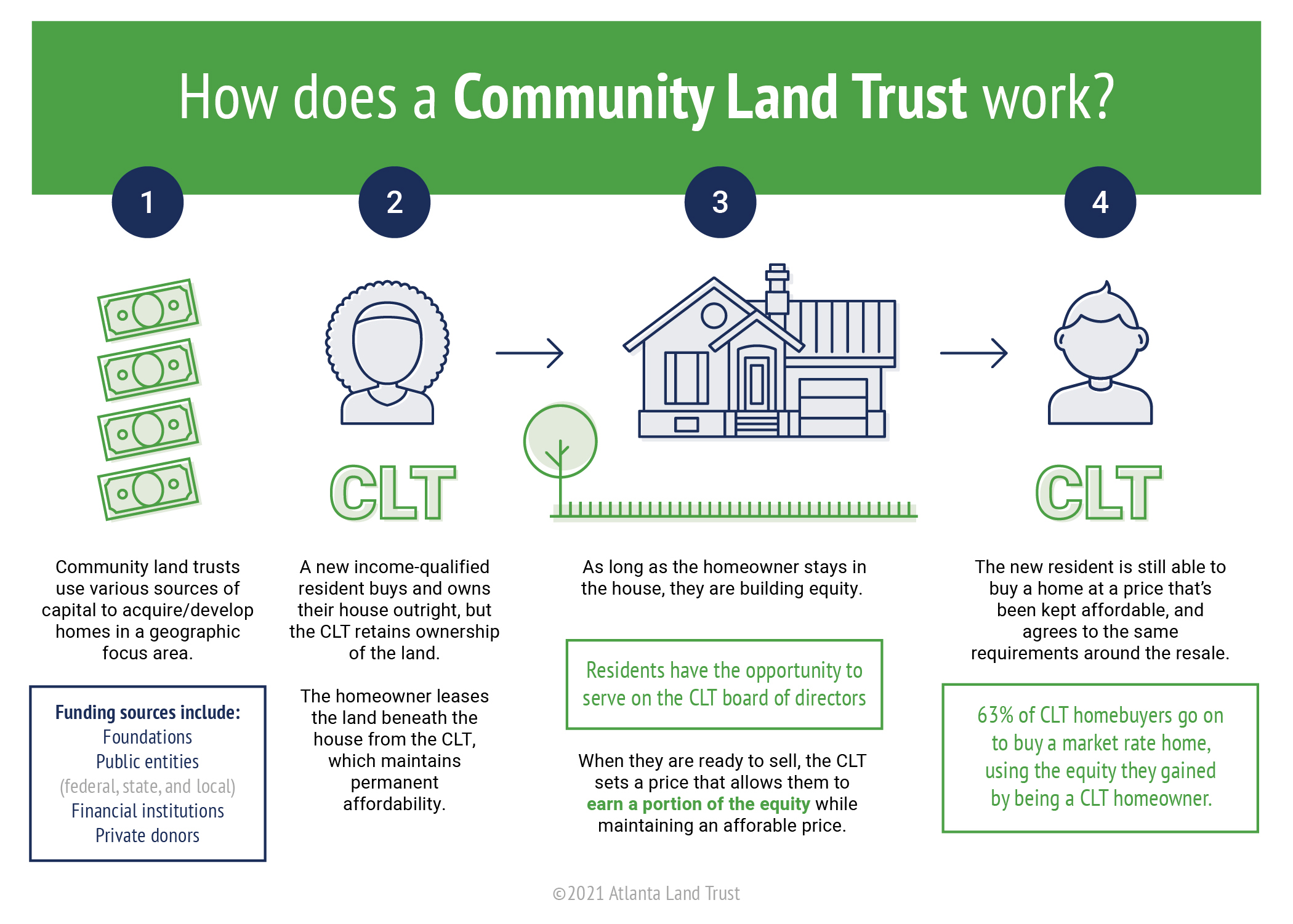

A community land trust or CLT can help with these problems. The CLT will create affordable housing from dilapidated buildings and promote home ownership with built-in safeguards to keep the housing affordable long-term.

What is a community land trust?

A community land trust or CLT is a non-profit that obtains land and acts as a steward of that land long-term in the interests of a community. The CLT members create policies about how their land can be used. Typically, CLTs use the land for affordable housing.

Image from Atlanta Land Trust

How it could work in Wheeling:

- The CLT buys or is donated a dilapidated building.

- The CLT works with an interested resident and relevant experts to make a plan for the building.

- The resident buys the building from the CLT while the CLT retains ownership of the land.

- The CLT and new owner work together to make the building liveable.

- The owner makes monthly lease payments to the CLT and continues to build equity.

- The owner eventually sells their home to a new resident with the oversight of the CLT.

The membership and board will have three parts to represent different members of the community:

- CLT Residents

- Community members

- Relevant experts and elected officials

If you’re interested in becoming a member or helping in any other way, please fill out the form below and we’ll get in touch.

More resources about CLTs

- Community Land Trusts 101 presentation video (30 mins) from the Metropolitan Council in St Paul, Minnesota

- Short explainer video from the Community Land Trust Network (UK)

- Grounded Solutions Community Land Trust Technical Manual - Grounded Solutions has many other resources as well.

- Community Land Trusts as Part of a Just Transition from ReImagine Appalachia

Plan and Timeline

- Hold first interest meetings (November 2025)

- Build relationships locally and regionally (ongoing)

- Gather initial membership and board (November-December 2025)

- Draft bylaws (December 2025)

- Develop 1-year and 5-year execution plans starting (January 2025)

- Develop first budget by April 2026

- Obtain first property by July 2026

CLTs in our region

- City of Bridges - Pittsburgh, PA

- Hough Community Land Trust - Cleveland, OH (article)

- Oberlin Community Land Trust - Oberlin, OH (Facebook, article)

- Central Ohio Community Land Trust - Columbus, OH (article)

- Centre County Housing and Land Trust - Centre County, PA (State College)

- Yellow Springs Home - Yellow Springs, OH

FAQs

Is this the same as a “land bank”?

No, a land bank is typically a public entity run by a city or county that gives the government more power to manage and hold land for future development.

Community land trusts are a form of nonprofit organization that stewards land and provides opportunity for home ownership to low-income people.

Land banks and community land trusts can work together but they aren’t the same.

Where will the money come from?

The community land trust would need income from multiple sources to be sustainable.

A few sources of income or revenue are built into the CLT model:

- Lease payments - The CLT leases land to home owners, and some maintenance costs can be incorporated into this fee.

- Membership - CLTs are typically membership organizations, so they can charge dues to members.

- Building sales - While the CLT retains ownership of the land, it does sell the building to new residents.

If an old building is donated to the CLT, the CLT members can invest sweat equity into fixing up the building. By selling the improved building to a new resident, the CLT generates revenue that can be used toward future projects.

Usually, the new residents are low-income, and the cost they can pay for a building is going to be significantly lower than market-rate. But the CLT also doesn’t have to sell all of its buildings to low-income residents. Revenue from selling nicer buildings to middle-income residents could help subsidize projects for lower-income residents.

All this means that the CLT can generate revenue from:

- Unskilled volunteer labor

- Skilled volunteer labor

- Donated or discounted building supplies

For some of this labor, the CLT can partner with local unions and technical schools. Community land trust buildings can be excellent learning opportunities for students and apprentices.

Finally, money can come from:

- donations

- federal, state, and local grants

- loans

Some specialized loan funds offer “patient money” with low rates to programs like community land trusts.

The value of donated supplies, land, and labor of can often also be considered match funds when applying for grants.

Team

Libby Horacek

Libby Horacek grew up in Moundsville and has lived in the Valley most of her life. In 2015, she left Wheeling to start a career in technology. She was hired at Position Development, a small software development consultancy. For the next five years, she helped the business convert from a traditional LLC partnership to a worker-owned cooperative, and in the process, joined New York City’s vibrant solidarity economy.

Libby moved back to Wheeling in 2020 while continuing to work remotely for Position Dev. She was a member of the board of trustees for Elm Grove Civics in 2024 and is currently a member of Ohio Valley Mutual Aid. Libby has felt for years that a community land trust is a missing piece in Wheeling’s housing systems and is determined to make it happen.

Melissa Burch

Melissa Burch is a graduate of the former Wheeling Jesuit University, where she studied psychology and philosophy. Volunteer work, advocacy, and service to others has been a large part of her driving purpose as strives to build equity and inclusion based on those values. Melissa is currently self employed in the Wheeling Area. Her work experience is diverse, including 4 years of Americorps, restaurant work, education, and telecommunications. She seeks to expand her career into the legal profession and is currently studying for the LSATs before applying to law school at WVU. Being involved in building a land trust development is just one of the many ways she hopes to build community in the Greater Wheeling area for years to come.

Contact Libby with any questions - emhoracek@gmail.com